Millennials are bombarded with constant reminders and tips to save money for retirement. But what about those in the generation before them? Those who have not stashed anything in their retirement plan? Is it too late for them? We say, it’s not.

Retirement Savings Among Older Workers In Numbers

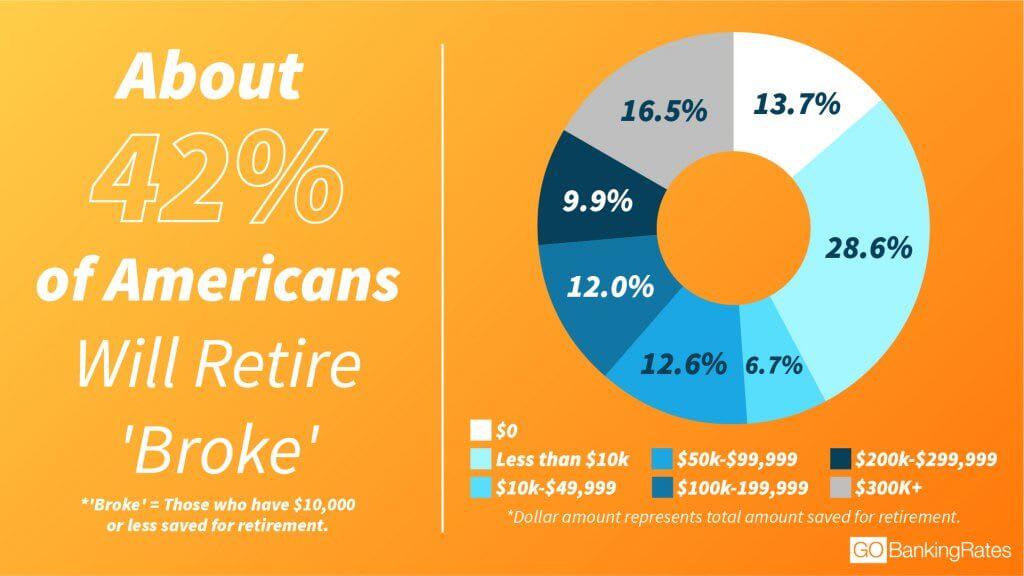

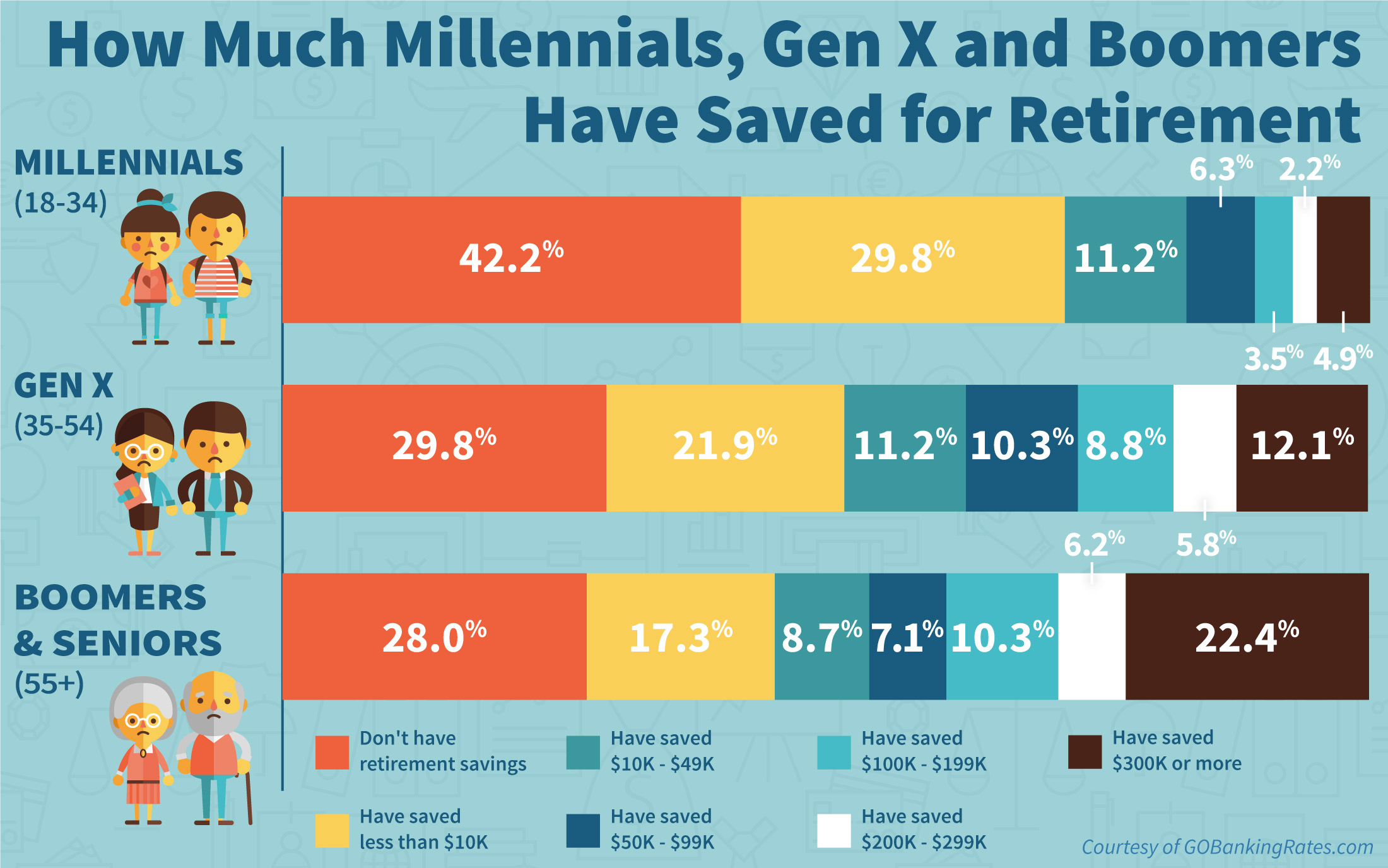

GoBankingRates research found that 42% of Americans will retire broke and around 30% of 1,504 adults over the age of 55 have no retirement savings.

The positive news, however, is that 26% of those aged 55 to 64 have balances greater than $200,000. Among the over-65-year olds, 31% had $200,000 or more in their retirement accounts.

Still, this infographic gives a broader picture of the state of Americans’ savings today, demanding a call to take action.

How to Save Money for your Retirement

1.) Set a Realistic Target

Image source: Gerd Altmann from Pixabay

Most tend to succumb to sensationalized images of living the retirement phase cruising by the sea or traveling the world. Hence, we tend to aim for ambitious financial plans beyond what is reasonable. As a result, we neglect our core priorities to invest in more important things like our health.

You may want to use online calculators to calculate the annual taxes you pay during retirement; your social security account, pension details to estimate just how much a boost these can be to your overall income, and others to help you reel in your realities in focus.

At the end, it will recommend how much you should save up monthly to achieve your financial target.

2.) Delay Retirement

Working past the Social Security retirement age, which is at 66 or 67, can help you save up more.

Aside from the continuous income sourced from your basic salary, an 8% increase will automatically be injected to your benefit payments in every year you decide to put off retiring—at least until your 70.

With this, you’ll enjoy the higher incentives that buoy your annual salary for continuing to wake up at 8 in the morning.

3.) Invest in Additional Income Streams where you can Generate Revenue Now and in the Future

Image source: Pete Linforth from Pixabay

There are many channels for profit which you can start trying out:

- Add more money in your retirement accounts

401(k) plans allow employees aged 50 to boost their contributions to $24,500 a year, a $6,000 addition to the $18,500 annual limit. These can be applied if companies recognize this catch-up rule.

Meanwhile, you should familiarize yourself with the policies of traditional and Roth IRAs. Although both have contribution limits of $5,500 — and an additional $1,000 annually after reaching 50 — the latter has no annual income limits while the former has none.

- Put up a business

It’s always a dream to go into a business, especially when you see entrepreneurs enjoying their time while they wait for cash. However, it’s not as easy as you think.

The planning and financing aspects may be the most crucial parts in putting up a business. It also requires identifying a good business location, being hands-on in marketing your product or services and a regular checkup and handling of your financial statements. Efforts in establishing a business will also continue even after you retire.

4.) Start Budgeting

Image source: Clker-Free-Vector-Images from Pixabay

This action plan may involve organization and ranking of priority expenses which you can easily do in spreadsheets. After identifying these, indicate how much money you made, how much you will have to spend on basic necessities (e.g. food, rent or mortgage, etc.), and how much you have remaining for savings.

Of course, this action plan requires slashing debt and not getting into any more debt. The little things matter–don’t swipe your credit card to dine out, cook as much as possible, or control the urge to indulge in shopping.

It’s Not Too Late

Image source: Andrea Piacquadio from Pexels

A study commissioned by the IFS Retirement Savings Consortium and the Economic and Social Research Council attempted to understand why some are laidback in saving up for their later years.

In their report, they found that individuals in their 50s and 60s underestimate their chances of reaching age 75 by around 20 percentage points and to 85 by some 5 to 10 percentage points.

The pessimism correlates to health risks of an early death of their parents, among other factors. However, the IFS report found that those who underestimate their chances of surviving may mean that individuals save less during working life, and spend more in the earlier years of retirement than is reasonable given their actual survival chances.

“Pessimism may make individuals reluctant to buy annuities,” the report said.

Meanwhile, it concludes that “optimism about survival at the oldest ages means that if individuals survive through their 80s, they may then be overly reluctant to spend down their wealth, potentially reducing their overall living standards.”

So to achieve your financial targets for your retirement plan, even at your current age, be and think positive. It is not too late. Come up with an action plan and stick with it.

Which steps are you going to take today to live a good life once you retire? Let us know in the comments below.